Our Solution

FinBlaze transforms MBS and ABS dealer desks with innovative tools that enhance team collaboration, streamline workflows, uncover siloed liquidity, and improve price discovery, all to drive stronger client engagement and deliver measurable ROI.

Core Features

BWIC Management

FinBlaze reduces manual aggregation of BWICs, streamlines collaboration between Sales and Trading teams, helps with price discovery, and improves client engagement.

The system’s proprietary technology automatically parses and standardizes incoming BWICs and creates a comprehensive BWIC Calendar with user access based on roles and entitlements. BWIC lifecycle tracking significantly improves teamwork and client response time.

Street Offer Aggregation

FinBlaze can ingest and intelligently process a large volume of street offers received from other dealers, often over 10,000 unique offers per day, and organize them in a standardized, searchable database that provides valuable price discovery.

Dealer offers can be aggregated at “story level” to address client inquiries quickly and efficiently. New and updated offers are highlighted to provide clues on market activity and identify trading opportunities.

Inventory Management

FinBlaze allows traders to share real-time inventory updates with performance notes to help sales teams engage with their clients quickly and efficiently. Integrations to email and electronic trading platforms enables easy distribution to clients.

Additionally, FinBlaze allows traders to compare their offers with other street offers to ensure competitive pricing. Trace and BWIC matcher alerts also provide traders with quick price discovery.

Bond / Deal Activity

FinBlaze allows traders to share real-time inventory updates with performance notes to help sales teams engage with their clients quickly and efficiently. Integrations to email and electronic trading platforms enables easy distribution to clients.

Additionally, FinBlaze allows traders to compare their offers with other street offers to ensure competitive pricing. Trace and BWIC matcher alerts also provide traders with quick price discovery.

Features for Sales

Client Relationship Management (CRM)

FinBlaze allows salespeople to track a client’s portfolio, monitor their trading activity by product, and maintain detailed notes on any requirements they may extract from their interactions.

Access to past trades, bids, BWICs, messages, contacts and notes gives a salesperson all the tools to confidently engage with clients. Institutional notes on clients allow firms to provide continuity in coverage and minimize information loss due to team turnover.

Axe & Matcher Alerts

Salespeople can use ‘Monitoring Bots’ to track incoming BWICs and Offers; alerting them if there is any activity that may benefit their clients.

In a market that rewards tailormade client service, FinBlaze provides timely alerts so that a salesperson can be the first to reach out to a client when there is a trading opportunity that can specifically address a client’s needs.

Client Reporting Templates

FinBlaze allows salespeople to create customizable report formats with targeted and relevant data for each client.

The days of blasting generic reports to all clients are over. Instead, using automation and FinBlaze’s ability to create custom reports targeted to each client’s specific needs demonstrates the salesperson’s commitment and leads to more productive conversations.

Sales Coverage Management

FinBlaze offers a comprehensive solution for sales managers to assign client coverage based on product knowledge, past relationships, and the client’s evolving priorities.

Salespeople can view available client accounts and can request their manager for coverage. Sales managers can assess client’s activity and sales interactions to determine if coverage needs to be modified for higher productivity.

Integration and Customization

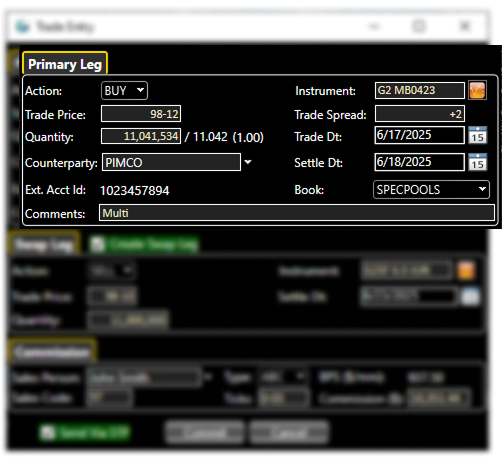

Trade Entry & STP

FinBlaze’s mission is to help Sales and Trading generate more trades, and to achieve that goal, it streamlines trade entry and straight-through processing with middle-office systems.

In an age where strict Trace requirements put immense pressure on timely trade reporting, FinBlaze’s quick trade entry and seamless STP help firms reduce manual errors and reduce reputational risk.

eTrading Connectivity

With the evolution of eTrading in MBS/ABS securitized products, FinBlaze has APIs and adapters that make connectivity with these eTrading platforms painless and efficient.

FinBlaze allows its users to engage in the electronic markets for BWICs and Offers. It captures incoming bids and enables offer negotiations through its own interface, shielding its users from dealing with multiple interfaces and preserving screen real-estate.

Security Master, Trace, Analytics

FinBlaze interfaces to popular third-party and proprietary adapters for security indicatives, analytics and trace data. Ingesting data from these diverse sources helps provide a complete and holistic view to the users.

Clients can integrate and use any licensed data and analytic sources in FinBlaze so that it can be used as a central hub for accessing all information through a unified front-end application.

Data Access through APIs and Excel

FinBlaze offers an Excel Add–In and well–documented APIs to interact with data stored in FinBlaze. These bi-directional interfaces allow clients to extract, modify, and store data in Fin Blaze’s centralized database.

Firms can use the API to access new BWICs as they are scraped into the system and incorporate proprietary pricers to bid automatically on these BWICs. Similar functionality is also available to firms that prefer using the Excel interface.